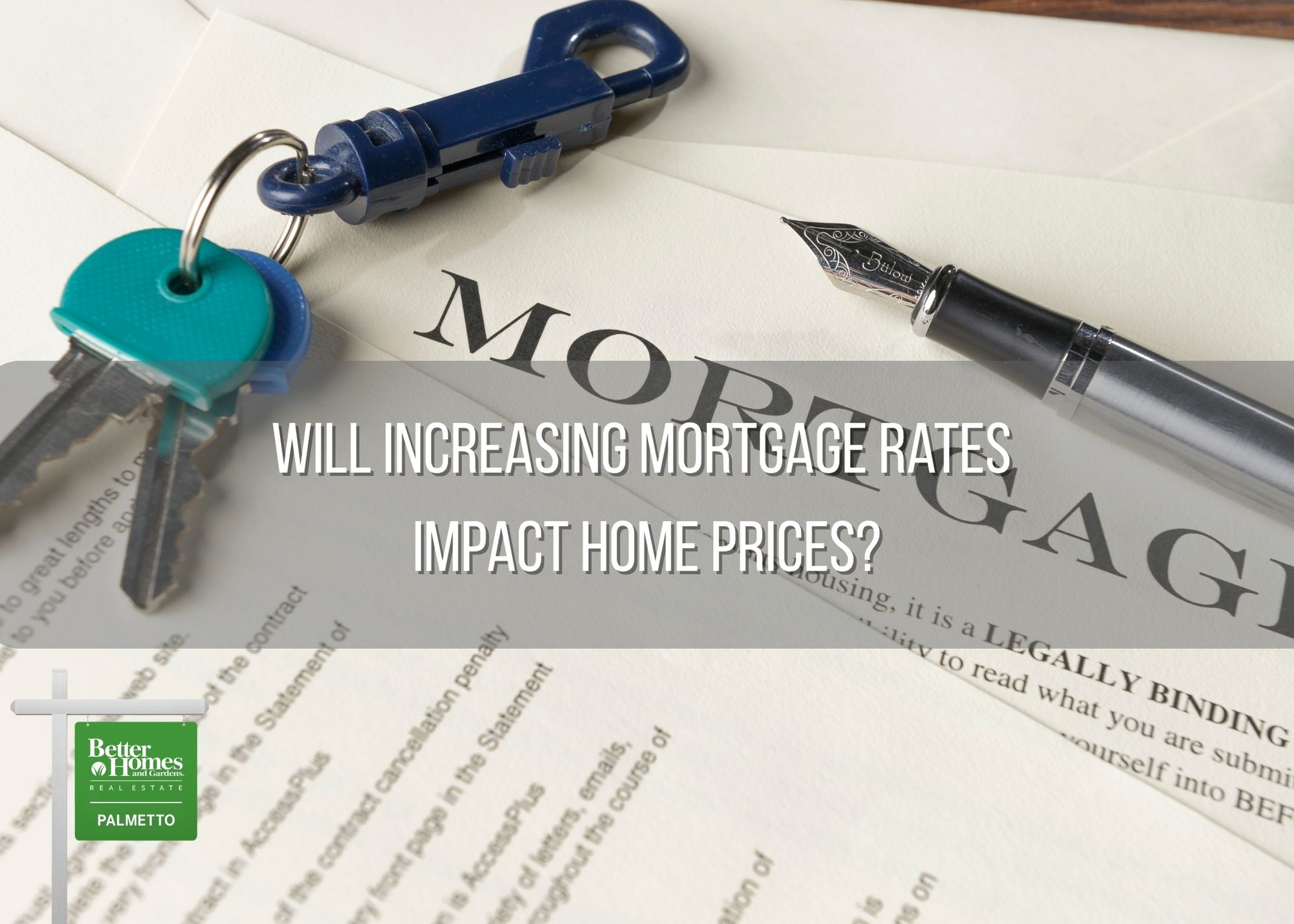

Will Increasing Mortgage Rates Impact Home Prices in Charleston, SC?

If you’ve been following the Charleston real estate market lately, you’ve probably heard one question over and over again:

“Are rising mortgage rates going to cause home prices to drop?”

It’s a fair concern and one that’s top of mind for both buyers and sellers in the Lowcountry. While higher interest rates do influence affordability and buyer activity, the connection between rates and home prices isn’t always straightforward, especially in strong, desirable markets like Charleston, Mount Pleasant, and Summerville.

Let’s break down how today’s mortgage rate trends are shaping our local market and what it means for you whether you’re planning to buy or sell.

1. Higher Rates Don’t Always Mean Falling Prices

It’s easy to assume that when mortgage rates rise, home prices automatically fall, but that’s not always the case.

In Charleston, the market remains resilient thanks to strong demand, limited inventory, and a steady stream of new residents relocating from across the country. People are still drawn here for the lifestyle, job growth, and coastal beauty, and that demand helps keep prices stable even as borrowing costs climb.

That said, price growth has slowed compared to the rapid increases of 2020 to 2022. Instead of sharp jumps, we’re seeing more moderate appreciation and a shift toward realistic pricing a healthy correction for long term market stability.

2. Affordability Is Changing Buyer Behavior

There’s no denying that higher mortgage rates affect how much buyers can afford. A higher rate means higher monthly payments, which can push some buyers to:

-

Explore smaller homes or different neighborhoods

-

Consider new construction offering incentives or rate buydowns

-

Take more time to get pre-approved or wait for rates to drop

Sellers should keep this in mind when pricing their homes. Overpricing in a high-rate environment can cause listings to sit, even in popular areas like Nexton, Cane Bay, and Daniel Island. Pricing smart and showcasing real value is more important than ever.

3. Inventory Still Favors Sellers (for Now)

Charleston’s biggest market factor right now isn’t interest rates it’s inventory.

Even with rates rising, there simply aren’t enough homes available to meet buyer demand. Many homeowners who refinanced at historic low rates are hesitant to sell, which keeps housing supply tight.

That limited supply has helped home prices hold steady despite affordability challenges. In fact, well-maintained homes in desirable areas are still attracting multiple offers when priced correctly.

If inventory stays low through the next several months, we’re likely to see prices level off rather than drop significantly.

4. What Buyers Should Do Right Now

If you’re thinking about buying, rising rates shouldn’t automatically scare you off. Instead, focus on strategy.

-

Get pre-approved early. Know exactly what your budget looks like in today’s rate environment.

-

Explore lender programs. Many offer rate buydowns or closing cost assistance to offset higher rates.

-

Think long-term. Remember, you can refinance later if rates drop — but home prices may keep climbing.

Charleston’s market still offers great opportunities, especially for buyers who act before competition heats up again.

5. What Sellers Should Know

For sellers, this market still offers strong potential, but it requires strategy and preparation.

-

Price competitively from the start.

-

Stage your home to stand out online and in person.

-

Partner with a local agent who understands neighborhood level demand and can attract qualified buyers.

At Better Homes and Gardens Real Estate Palmetto, we help our sellers position their homes smartly balancing strong pricing with realistic expectations to ensure fast, smooth closings.

The Bottom Line

Rising mortgage rates are reshaping how buyers and sellers approach the market, but they haven’t derailed Charleston’s strength.

With steady demand, limited inventory, and long term appeal, the Lowcountry continues to perform well compared to other regions.

Whether you’re buying or selling, the key is working with professionals who understand these market shifts and can help you make the best move for your goals.

At Better Homes and Gardens Real Estate Palmetto, we’re here to guide you every step of the way.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link