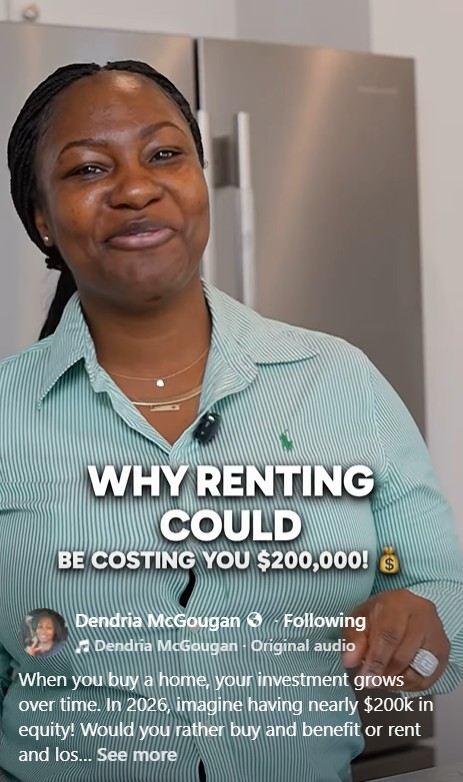

Why Buying in 2026 Could Mean $200K in Equity

If you’re still renting in 2026, here’s the straight truth: you’re helping someone else build wealth.

When you buy a home, you’re not just paying a mortgage. You’re building equity. And over time, that equity can grow into serious money.

Let’s paint the picture.

Between appreciation and paying down your loan, it’s very realistic for homeowners to build substantial equity over the years. In many markets, homeowners who bought just a few years ago are already sitting on significant gains. Now imagine being in a position where your home has built nearly $200,000 in equity.

That’s not just a number.

That’s options.

• Money toward your next home

• Funds for renovations

• A financial cushion

• Retirement leverage

• Investment opportunities

Meanwhile, rent continues to rise — and none of it builds ownership.

Yes, buying requires planning. Yes, interest rates matter. But time in the market has consistently outperformed sitting on the sidelines. The longer you wait, the more opportunity cost adds up.

The real question isn’t “Should I buy?”

It’s “How long do I want to delay building wealth?”

If you’re curious what ownership could look like for you in 2026 payments, loan options, or what kind of home fits your budget — let’s talk through it. No pressure. Just strategy.

Dendria McGougan

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link